Smart Homes in Dubai: Are They Worth the Investment?

Dubai has stood as the epitome of innovation with world-class aesthetics for decades.

The rapid advancements in technology and the integration of smart systems have indeed redefined modern living in the UAE.

With that, the concept of living in smart homes in Dubai has transformed from a futuristic vision into a practical lifestyle reality.

From energy efficiency to enhanced security, smart homes are no longer a luxury reserved for a few. They are becoming a defining feature of real estate projects.

For investors, homeowners, and tenants, understanding the value of smart home installation in Dubai is crucial before making a decision.

This article explores whether smart homes truly justify the investment, particularly in a competitive real estate market where lifestyle amenities and technological convenience are increasingly prioritized.

What Defines a Smart Home?

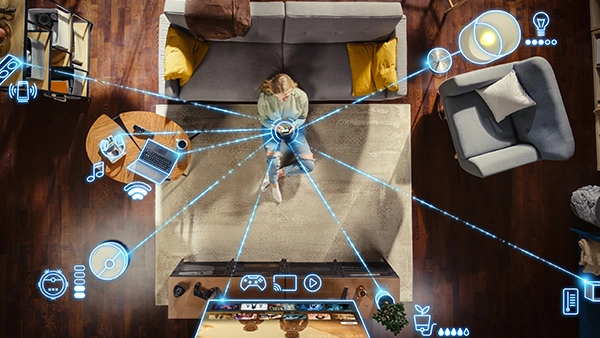

A smart home integrates technology and automation into everyday living. Such innovations simplify daily routines, improve energy efficiency, and enhance safety.

And when investing in properties in Dubai, these features are more than just added benefits.

For end-users, they are evolving into standard expectations, and for investors, it means having a sorted outlook on smart homes in Dubai.

Some features that make a smart home include:

- Intelligent lighting systems that adjust based on natural light.

- Climate control features, such as automated thermostats.

- Voice-activated assistants and centralized home automation.

- Security systems, surveillance cameras, biometric access, and motion detectors.

- Remote control of appliances and utilities through smartphones.

The Growing Demand for Smart Homes in Dubai

With the UAE positioning itself as a hub for innovation, technology, and luxury living, real estate developers in Dubai are increasingly integrating smart home features into new residential projects.

This demand is driven by:

-

Lifestyle Aspirations:

Tenants and buyers are actively seeking comfort, convenience, and innovation.

From voice-activated assistants to centralized control of lighting, air-conditioning, and appliances, smart home technology enhances daily living, making it more seamless and enjoyable.

-

Sustainable Living:

In alignment with Dubai’s Smart City initiatives, automated systems encourage sustainable living by reducing energy and water wastage.

Homes equipped with intelligent sensors and IoT devices directly contribute to the city’s sustainability goals.

-

Security Concerns:

Smart homes feature advanced security solutions with features like biometric entry, AI-powered surveillance, and remote monitoring.

This ensures residents enjoy both safety and peace of mind.

-

Higher Resale and Rental Value:

Properties equipped with advanced automation often enjoy higher resale and rental demand.

Buyers view these homes as forward-thinking investments that guarantee long-term value.

For buyers considering properties for sale in Dubai, homes that include built-in automation would be great deals, considering the benefits and demand for smart home installation in Dubai.

Benefits of Smart Home Installation in Dubai

When combining innovation, sustainability, and luxury living, smart home technology has become an integral part of Dubai’s real estate landscape.

While prime locations and elegant interiors play a pivotal role, modern buyers and tenants want more. They now seek intelligent solutions that offer security, convenience, and greater value.

For investors and homeowners, smart home installations go beyond lifestyle upgrades. They enhance property value, reduce operational costs, and align perfectly with Dubai’s vision of a smart and sustainable city.

Below are the key benefits of investing in a smart home in Dubai:

1. Enhanced Security

For residents and investors, safety and security have always been a top priority.

Smart homes incorporate motion sensors, high-definition CCTV cameras, and biometric access, ensuring the property is safe and secure.

2. Energy Efficiency and Cost Savings

Smart home installations, like automated climate control and intelligent lighting, directly reduce energy consumption.

Over time, this contributes to significant savings on utility bills, making smart home installations both eco-friendly and cost-efficient.

3. Convenience and Comfort

From controlling appliances remotely to adjusting lighting with a single command, smart homes deliver unmatched convenience.

Such features are especially appealing to global investors looking for real estate developers in Dubai who can deliver modern and future-ready homes.

4. Increased Property Value

In this era of modernity, smart home features elevate the desirability of properties.

In a competitive market, apartments or villas equipped with advanced automation attract premium pricing.

And for long-term investors, this translates into higher resale and rental potential.

5. Lifestyle Enhancement

The UAE emphasizes innovation and futuristic living, and smart homes reflect this essence.

Owning or renting smart homes aligns with the image of Dubai as a modern, forward-looking city.

The big question for many buyers and investors is whether smart homes justify the investment. Let’s discuss that.

Are Smart Homes Worth the Investment?

The answer depends on the perspective of the buyer or investor.

From a financial standpoint, smart home installation in Dubai adds strong value to the property.

The tangible benefits include energy savings, enhanced property appreciation, and reduced maintenance costs. Peace of mind, convenience, and a modern lifestyle experience are add-ons.

And real estate developers in Dubai are seamlessly incorporating these features as part of their commitment to innovation.

In a market where lifestyle-driven investments dominate, smart homes are becoming the new normal. And Danube Properties stands at the forefront of delivering homes that meet the evolving needs of residents.

By integrating smart home technology into residential developments, Danube ensures that properties remain future-ready, sustainable, and attractive for investors and tenants.

However, before making a purchase, it’s important to evaluate the long-term implications of investing in a smart property.

Factors to Consider Before Investing in Smart Homes

While smart homes in Dubai offer unmatched security, convenience, and long-term value, buyers and investors need to approach such investments strategically.

Smart technology can significantly enhance property desirability, but to make an informed decision, investors should evaluate several key factors before committing to a smart-enabled property:

-

Initial Costs vs. Long-Term Gains:

Smart installations require upfront investment, but the long-term savings and property appreciation outweigh the initial expenses.

-

Compatibility and Upgrades:

Technology evolves rapidly. Properties should offer flexibility for future upgrades to avoid becoming outdated.

-

Developer Expertise:

Choosing a reliable real estate developer in Dubai ensures that smart home systems are installed and maintained to the highest standards.

-

Market Trends:

With increasing interest in smart homes across the UAE, properties neglecting these features may lose demand in the future.

The Future of Smart Homes in Dubai Real Estate

As sustainability, technology, and luxury continue to define urban living, smart homes are expected to dominate Dubai’s residential landscape. The trends include:

- AI-powered energy grids within communities.

- Fully integrated smart cities offering seamless connectivity.

- Voice-controlled home ecosystems.

- Advanced health monitoring through in-home devices.

For investors evaluating properties for sale in Dubai, these developments indicate long-term value and greater ROI.

Conclusion

Smart homes are no longer an experimental concept, and they are becoming a cornerstone of modern residential living in Dubai.

With benefits such as enhanced security, energy efficiency, convenience, and increased property value, the appeal of smart home installation in Dubai is undeniable.

And real estate developers in Dubai, like Danube Properties, recognize this shift and continue to deliver homes that blend innovation with lifestyle aspirations.

For those exploring properties in the UAE’s dynamic real estate market, investing in a smart home is a step toward securing long-term value.

In conclusion, smart homes in Dubai are not just worth the investment; they represent the future of residential living.