Apartment Investment in Dubai: What Drives Rental Demand Today?

In today’s highly competitive real estate environment, investment in Dubai is driven by measurable demand, demographic momentum, regulatory stability, and economic resilience.

Among all asset classes, apartments in Dubai continue to attract the highest investor interest due to their consistent rental performance and long-term growth potential.

However, successful investors rely on data, fundamentals, and market structure.

Data sourced from DLD reports featured on Bayut records 630,000+ rental transactions. The average annual rent reached AED 84,000+, and the average rental rate rose to AED 80 per square foot, marking year-on-year growth of 8.5% and 10%, respectively.

While the numbers are impressive, understanding what drives rental demand is essential for anyone considering buying an apartment in Dubai as part of their portfolio.

Having said that, let’s examine the key forces shaping Dubai’s rental market today and understand why demand remains strong across multiple residential segments.

Population Growth: The Primary Demand Engine

Every sustainable rental market is supported by population expansion. And Dubai continues to demonstrate one of the strongest population growth rates among global metropolitan cities.

Data from Gulf News & ValuStrat indicates that Dubai’s resident population crossed the 4 million mark in 2025 and is expected to rise to approximately 4.7 million by 2026, with peak-hour figures approaching 6.5 million.

This growth is primarily driven by employment opportunities, business relocation, long-term residency reforms, and global talent migration.

According to Khaleej Times, the total number of rental contracts increased by 5% in 2025, reaching a record 530,000 agreements.

Renewals made up to 62% of these contracts, indicating a more settled resident population and stronger tenant retention.

Most new residents initially choose rental housing, a pattern consistent among professionals, entrepreneurs, and expatriate families, accounting for the remaining 38% in leases.

With the above data, it’s certain that population growth directly translates into sustained demand for residential rentals. And this demographic reality is the foundation of long-term property investments in Dubai.

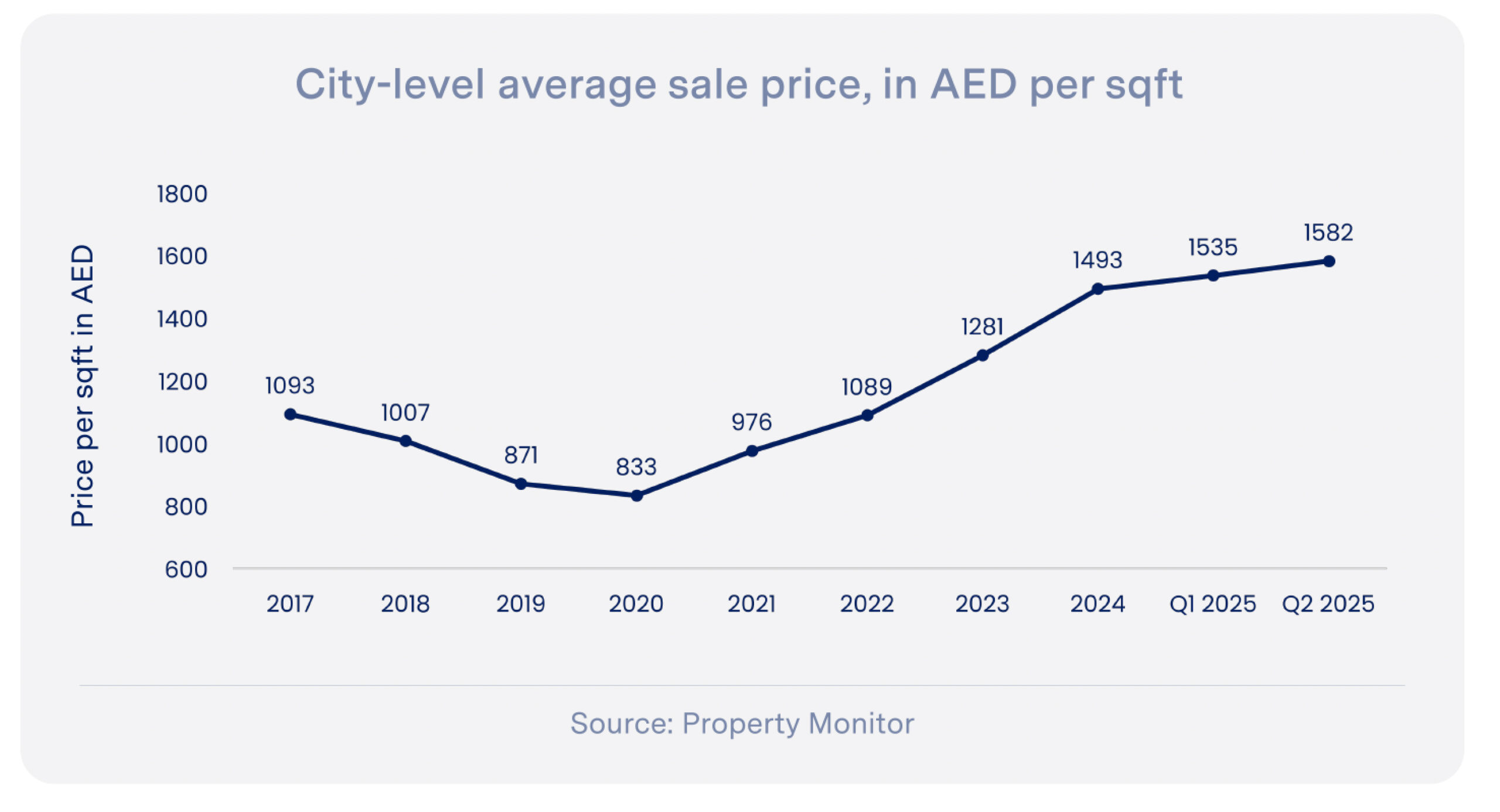

Byproducts: Rental Price Growth Reflects Structural Demand

Rental prices provide one of the clearest indicators of market strength. In recent years, Dubai has recorded substantial rent appreciation across major residential communities.

As reported by Estate Magazine, Dubai’s rental rates under long-term contracts rose by an average of about 13% in 2025, while short-term and holiday rentals posted more significant gains of up to 18%.

These numbers reflect real-time market appreciation rather than speculation, and they are driven by limited availability in desirable locations, rising professional migration, and improved tenant purchasing power.

For investors prospecting apartments in Dubai, rising rental values strengthen income stability and asset valuation simultaneously.

Apartment Rental Yields Across Key Communities in Dubai

The table below presents a comparative overview of average apartment rental yields across major residential communities in Dubai, highlighting where investors can currently achieve the strongest income returns.

| Community / Area | Approx. Gross Rental Yields for Apartments (2025) |

|---|---|

| International City | 8.0 – 9.0% |

| Dubai Sports City | 7.8 – 8.3% |

| Dubai Silicon Oasis (DSO) | 7.5 – 8.5% |

| Discovery Gardens | 7.3 – 7.8% |

| Jumeirah Village Circle (JVC) | 7.3 – 7.8% |

| Jumeirah Lake Towers (JLT) | 6.8 – 7.5% |

| Al Furjan | 6.8 – 7.5% |

| Dubai South | 7.0 – 8.0% |

| Business Bay | 6.5 – 6.9% |

| Dubai Marina | 6.0 – 6.5% |

| Downtown Dubai | 5.5 – 6.0% |

Reflecting on the data above, apartment investments in well-connected, demand-driven communities can be the most reliable sources of income in Dubai, reinforcing their role as core assets within diversified real estate portfolios.

More on thriving real estate: Dubai’s New Hotspots: Up-and-Coming Areas to Watch

Breakdown: Changing Tenant Preferences and Demand Patterns

Modern tenants are increasingly selective. Today, rental demand is concentrated in properties that serve lifestyle, functionality, and accessibility.

According to Khaleej Times, apartment leasing transactions rose 5% year‑on‑year. And with the median age in Dubai ranging from 31 to 33 years, an increasing number of residential units are made to appeal more to young professionals, small families, and corporate tenants, prioritizing:

- Proximity to metro stations and business districts

- Access to retail and healthcare facilities

- Digital connectivity and building maintenance quality

- Community amenities and security standards

As a result, developments that integrate these features maintain stronger occupancy and higher renewal rates.

This is where established developers such as Danube Properties gain a competitive advantage. Our focus on location strategy, efficient layouts, and practical amenities aligns closely with tenant expectations, making us the preferred developer for affordable, luxurious housing.

Market Stability: What’s Dubai’s Vacancy Rate?

Vacancy rates provide an objective assessment of rental market health. Low vacancy levels indicate sustained demand and efficient absorption of available units.

Sands of Wealth reports that Dubai’s rental vacancy rate remains within the 4% to 7% range across the city, indicating that most landlords secure tenants without prolonged vacancy periods.

Several prime and well-planned communities recorded vacancy levels below three percent.

These figures compare favorably with many global cities, where vacancy rates exceed 8%.

The global average vacancy rate rose to 16.9% in Q1 of 2025 as per JLL’s Global Real Estate Perspective, underscoring how Dubai’s lower vacancy levels help reduce income volatility and minimize holding risks for investors.

For those evaluating apartments for sale in Dubai as an investment, vacancy performance is a critical indicator of long-term viability, and Dubai satisfies the criterion well.

More on property investments: Why Dubai is the Leading Multi-Asset Investment Hub for Global Portfolios

Competitive Rental Yields in a Global Context

Dubai continues to deliver some of the highest residential rental yields among major international markets.

As of December 2025, the overall average rental yield in Dubai stood at around 6.8%.

Engel & Völkers cite that apartments led the market with the highest returns, averaging 7.07%, while villas generated comparatively lower yields, averaging 4.93%.

By comparison, yields in cities such as London, New York, and Singapore generally remain below 4%, with taxation further lowering them.

However, with no property tax in Dubai and comparatively higher rental yields, the appeal of property in Dubai continues to strengthen among regional and international investors.

Supply Dynamics and Market Absorption

Dubai continues to deliver new residential inventory. However, supply has not weakened rental demand due to uneven geographic distribution and differentiated quality.

Khaleej Times reports indicate that demand continued to focus on established communities within Dubai’s most active leasing zones.

Apartment rentals were strongest in Dubai Marina, JLT, and Business Bay, where strong transport links, lifestyle amenities, and investor-oriented developments converge.

Developers who emphasize connectivity, affordability, and design efficiency maintain stronger rental performance.

And that’s why at Danube Properties, we have consistently adopted this approach, which supports both tenant demand and investor confidence.

Regulatory Framework and Market Confidence

Dubai’s regulatory environment supports rental market stability through transparency and enforcement.

The Dubai Land Department has implemented digital tenancy registration systems, standardized rental index mechanisms, and clear dispute resolution frameworks.

These measures protect both landlords and tenants while reducing legal uncertainty.

Stable regulation encourages long-term ownership and institutional participation. And this regulatory maturity strengthens the credibility of investment in Dubai as a professional asset class.

Should Residential Investors Buy an Apartment in Dubai?

When population growth, rental pricing, vacancy rates, yields, supply dynamics, and regulation align, a market becomes structurally resilient.

Dubai’s residential rental market currently benefits from all these factors.

For investors seeking to buy an apartment in Dubai, this translates into predictable occupancy, consistent income streams, and strong resale liquidity.

Projects developed by Danube Properties are well-positioned, as they combine affordability, accessibility, and long-term livability.

Conclusion

Dubai has evolved into a mature, data-driven real estate market supported by strong economic and demographic fundamentals. Rental demand is driven by measurable forces rather than speculation.

Population growth, employment expansion, infrastructure investment, regulatory stability, and competitive yields collectively sustain the performance of apartments in Dubai.

In real estate, disciplined analysis always outperforms optimism.

For investors evaluating apartments for sale in Dubai, the evidence is clear. The market remains structurally strong, professionally regulated, and globally competitive.

And sustained rental demand is not a forecast. It is already reflected in the data.