Tired of Traffic? Here’s How Choosing the Right Home Can Save You Hours

There’s a hidden cost to urban success that rarely appears in financial spreadsheets: time lost in traffic.

In fast-growing metropolitan environments across the UAE, infrastructure has expanded rapidly, but so has population density.

The result is predictable. Commutes that once took 20 minutes now stretch past 50 minutes.

In H1 2025, RTA reported that public transport, taxis, and shared mobility services served 395.3 million riders, with an average of 2.18 million daily journeys across the transit network.

This shift has forced a smarter conversation about residential decision-making.

Today, location is prestige. Along with amenities, it protects time, preserves mental bandwidth, and enables a frictionless daily rhythm.

This is precisely where developments like Serenz by Danube Properties are reshaping expectations by promising luxury and strategically aligning connectivity, lifestyle efficiency, and long-term value.

The Real Cost of Commuting isn’t Fuel. It’s Your Life

Time is the only asset that cannot be replenished.

The INRIX 2025 Global Traffic Report indicates that motorists in Dubai lost up to 45 hours stuck in traffic in 2025, highlighting rising congestion challenges as population and vehicle numbers grow.

Beyond time loss, extended commutes are linked to measurable declines in productivity, higher stress levels, and reduced overall life satisfaction.

An analysis in Estate Magazine’s UAE Real Estate 2025 review states that projects lacking good road access or public transport connections are less attractive, and proximity to metro stations, bus stops, and major highways has now become a top priority for buyers and tenants in the market.

This is a fundamental shift. Buyers are no longer simply evaluating square footage. They’re evaluating life efficiency.

Why Strategic Location is Driving Residential Value in 2025

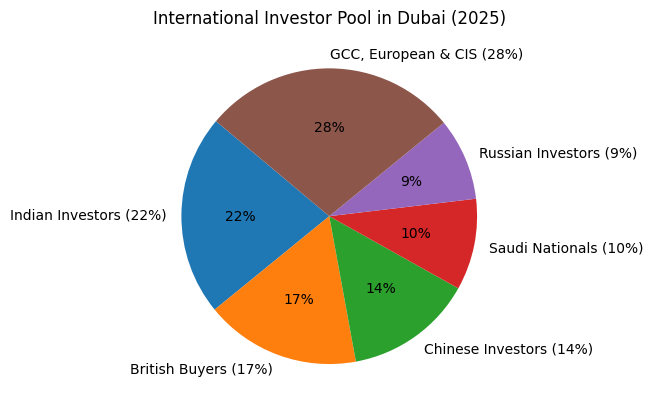

Real estate performance is increasingly tied to smart urban planning.

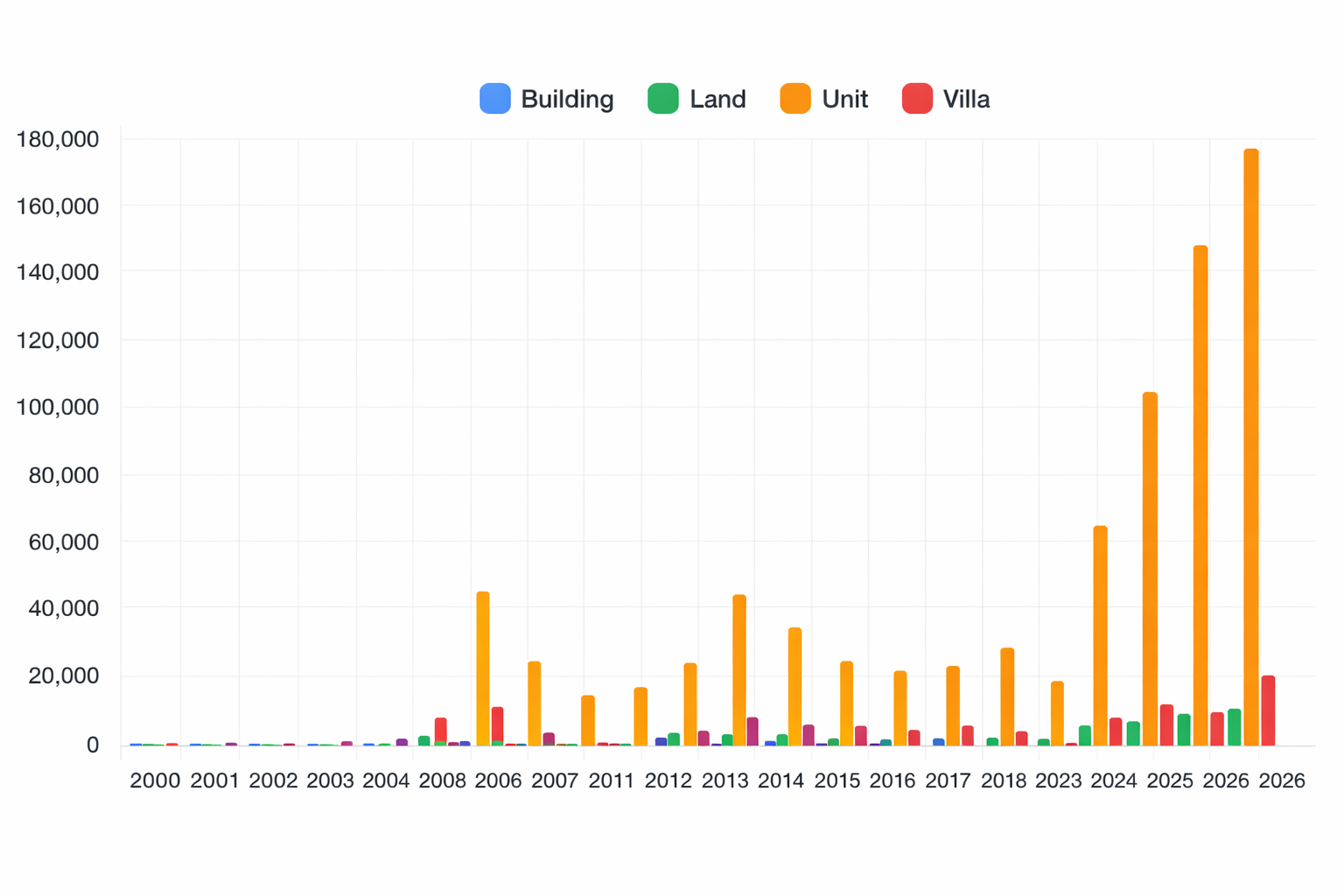

According to the Dubai Land Department, Dubai’s real estate market closed 2025 with record sales of AED 682.49 billion, significantly higher than the previous year’s total of AED 522.36 billion, making it one of the strongest years on record for transaction value.

Data from Nxt Citizens suggests that high-demand districts such as Downtown Dubai, Dubai Marina, and Jumeirah Village Circle can see returns climb even higher, reaching up to 11%.

This data reveals something important. Centrally positioned communities with strong connectivity outperform peripheral zones in capital appreciation and absorption rates.

This explains why modern buyers searching for a house for sale in Dubai are increasingly prioritizing accessibility metrics over aesthetic beauty.

Convenience has become an economic advantage.

Danube’s Serenz: Designed Around Movement, Not Just Living

What separates Serenz is its spatial intelligence.

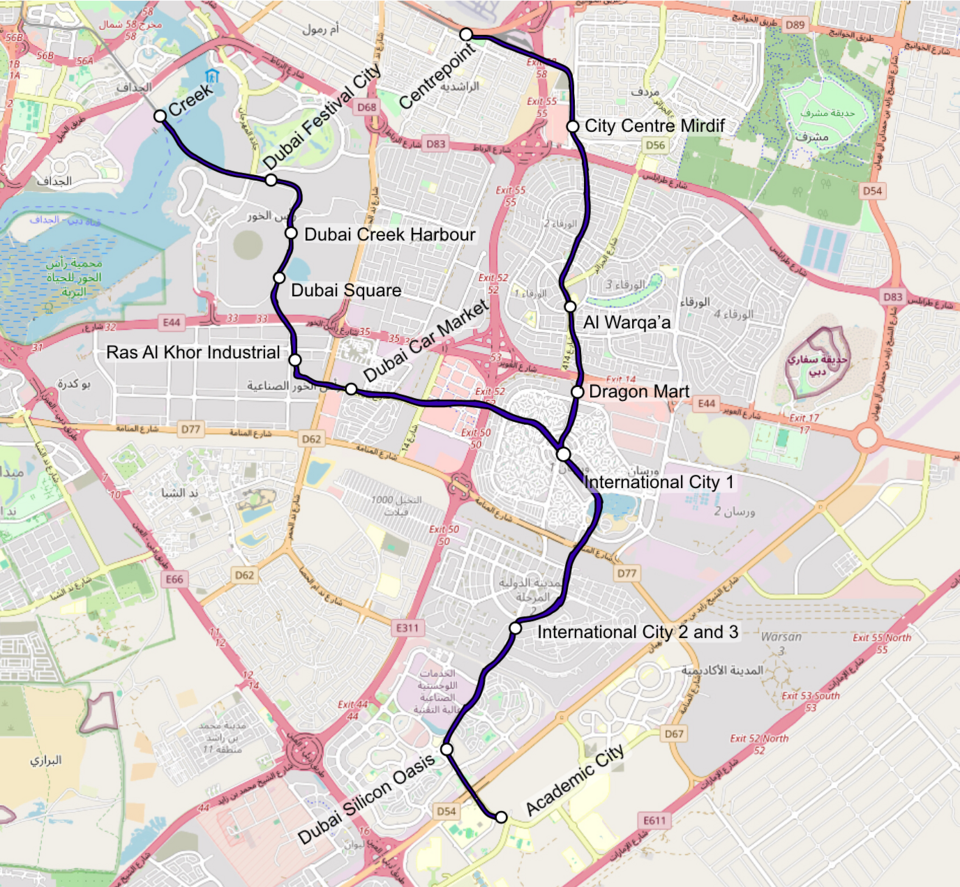

Developed by Danube Properties, Serenz is positioned within one of the most strategically balanced residential corridors.

With immediate access to Al Khail Road in just 2 minutes, residents can enter and exit the city’s main arterial network without navigating long internal bottlenecks or congested access roads.

From Serenz, essential destinations remain consistently within reach.

Circle Mall is just 7 minutes away, while Sheikh Zayed Road, Mall of the Emirates, and Internet City Metro are all accessible within 13 minutes.

Dubai Marina is a 16-minute walk away, reinforcing the development’s connection to one of the city’s most active lifestyle and employment hubs.

JLL’s UAE Real Estate Market Overview reports that retail spaces in prime locations have reached occupancy rates exceeding 97%, supported by sustained consumer footfall and a strong rebound in retail activity.

This clearly indicates that infrastructure proximity directly influences livability, commute reliability, and long-term residential desirability.

Serenz was planned with this exact logic in mind: bringing critical urban functions closer, reducing commute fatigue, improving schedule predictability, and enabling a smoother, more efficient daily rhythm.

Market Reality: Price Growth is Now Linked to Livability

There’s a misconception that residential prices rise purely due to speculation. In reality, modern growth is driven by usability.

Transaction data from Economy Middle East shows that house prices in Dubai increased approximately 8.4% in 2025.

Diving into the details showed that the strongest performance occurred in communities with integrated infrastructure, mixed-use planning, and efficient connectivity.

This reinforces a critical investment principle: homes designed around lifestyle efficiency retain stronger long-term value stability.

When evaluating any property in Dubai, proximity to infrastructure is no longer optional. It has become foundational.

Time Efficiency is Now a Core Luxury

Luxury used to mean marble finishes, skyline views, and premium amenities. Today, luxury increasingly means reclaiming time.

And developments like Serenz reflect this shift by integrating lifestyle convenience into core design philosophy.

Residents gain faster access to commercial zones, retail centers, and essential services, minimizing daily friction and maximizing functional living.

This creates measurable lifestyle improvements:

- Reduced commute duration

- Improved work-life balance

- Lower transportation costs

- Higher productivity

- Better long-term residential satisfaction

Moreover, these factors also influence rental demand and resale performance, strengthening financial resilience.

Does Developer Track Record Matter?

In mature markets, developer credibility directly affects buyer confidence and asset performance.

According to the Dubai Land Department, project completion reliability and delivery consistency have become key drivers of investor trust.

Developers with proven delivery records consistently achieve stronger absorption rates and faster post-completion occupancy.

Danube Properties has built its reputation on this exact foundation.

By combining disciplined execution, competitive pricing structures, and strategically selected locations, we have positioned ourselves among the best developers in Dubai.

And Serenz by Danube continues this trajectory as a carefully structured residential environment designed for long-term functionality and efficient commute.

The Bigger Picture: Urban Living is Being Redefined

Across the UAE, residential priorities are evolving rapidly.

Buyers and investors are no longer driven purely by aesthetics or branding. They are driven by measurable lifestyle efficiency, infrastructure accessibility, and long-term resilience.

Positioning reflects a deeper understanding of modern urban living.

And that’s where Serenz by Danube seamlessly aligns with these priorities.

Final Thoughts

When purchasing property, financial returns, appreciation, and rental income matter. But none of those compensate for the years lost in an inefficient daily commute.

In today’s world, the smartest residential decisions protect time first.

And Serenz by Danube addresses this challenge directly by combining connectivity, livability, and developer credibility into a single, coherent residential ecosystem.

Because in modern cities, the smartest residential investment is not just about where you live. It’s about how effortlessly you move around, and how effortlessly life moves around you.