Alternate Investment Opportunities for US Expats: Why Dubai Real Estate is Your Safe Haven

As global financial markets grow increasingly volatile, US expatriates are actively reassessing how and where they deploy their capital.

Traditional investment channels such as equities, mutual funds, and domestic real estate in the US are facing rising pressure from inflation, regulatory shifts, and geopolitical uncertainty.

In this environment, property investment in Dubai has emerged as one of the most credible and data-backed alternative investment avenues available today.

And this shift is supported by transaction volumes, yield performance, foreign capital inflows, and long-term economic policy.

For US expats seeking portfolio stability, income generation, and geographic diversification, Dubai’s real estate is a financial haven.

A Market Defined by Verified Growth

Dubai’s real estate sector has entered a mature phase characterized by institutional participation, regulatory transparency, and sustained liquidity.

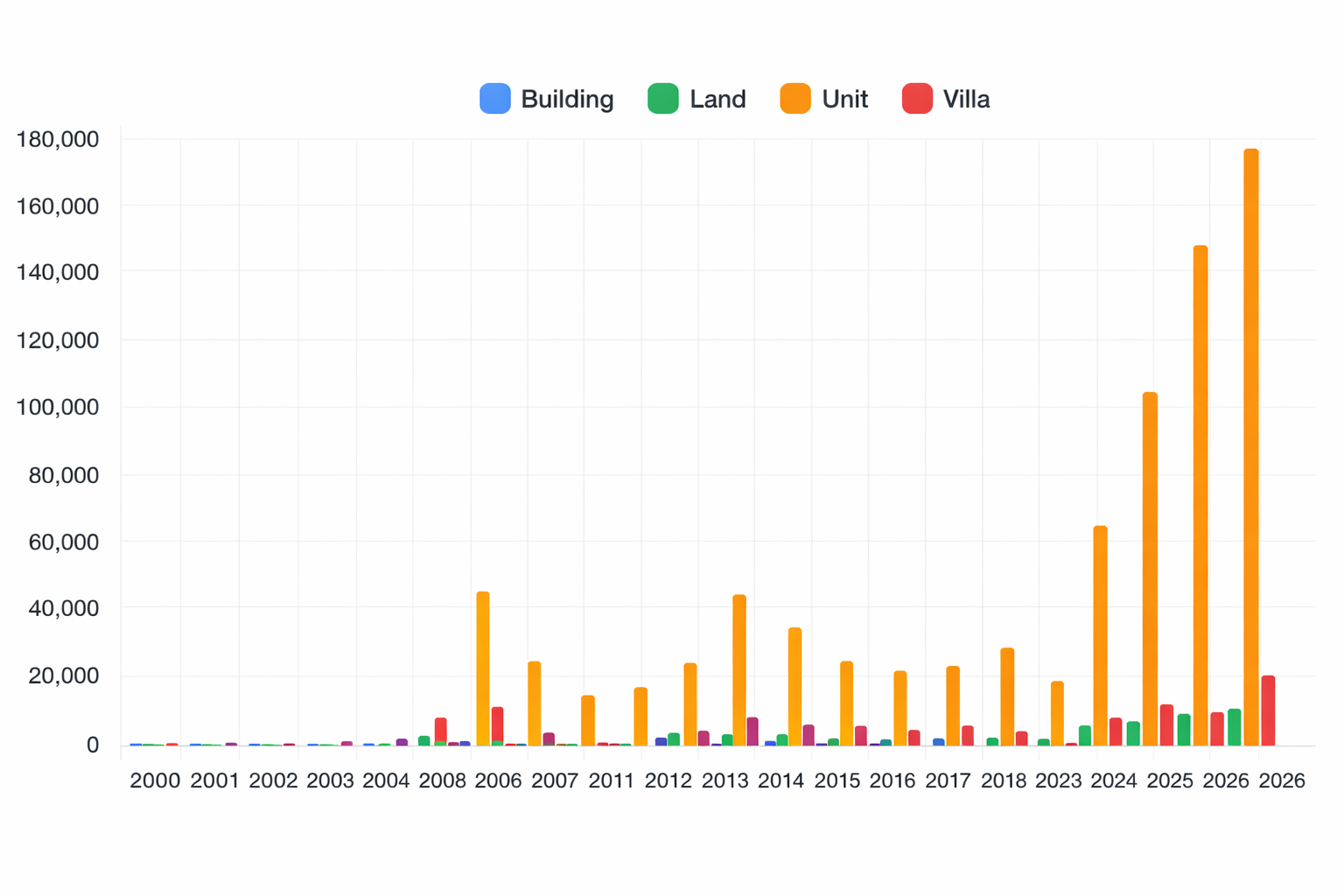

According to Property Finder, the UAE property market, led by Dubai, recorded 98,726 transactions worth AED 327 billion across all property segments in 2025, with the strongest quarterly sales performance in Q2.

Equally important is the nature of this demand. Data from Time Homes Real Estate states that foreign investors now account for over 40% of residential property ownership in Dubai, a level significantly higher than most major global cities.

This data confirms that investing in Dubai is driven by sustained international capital participation rather than speculative cycles.

Moreover, most buyers focus on individual units, signaling diversity as a key component across the market. This means there’s no monopoly, and investor confidence is widespread.

Tax Efficiency as a Structural Advantage

One of the strongest foundations of Dubai property investment lies in its tax structure. The UAE’s tax laws are highly favorable to property investors.

There is no capital gains tax on property sales, no annual property tax, and no income tax on residential rental earnings.

For US expats accustomed to state-level property taxes, federal capital gains exposure, and rental income taxation, this structure significantly improves net returns.

Estate Magazine has, in fact, reported that Dubai’s absence of property, income, and capital gains taxes results in a meaningfully higher after-tax return for property investors when all tax layers are accounted for, that is, 15-40% of retained income differences across markets.

And this structural efficiency is intentional. It is embedded within the UAE’s long-term economic model to attract global capital.

Rental Performance, Backed by Market Fundamentals

Sustainable real estate investment depends on consistent income generation, and Dubai continues to outperform many mature Western markets in this area.

Property Finder’s UAE Real Estate Investment Trends Report 2025 states that the average rental yield in the UAE was around 7.4%, with peaks above 9% in some communities.

And data from Global Property Guide shows that in major U.S. markets such as New York City, gross rental yields on mid-sized apartments come in around 3.8-4%, reflecting high property prices relative to rents.

Meanwhile, average rental yields in London hover near the low-to-mid 4% range according to the RPA Group.

The higher rental yields in Dubai are supported by high demand.

Dubai’s rental market is driven by professionals, entrepreneurs, multinational employees, and long-term residents who require quality housing across price segments.

This creates a stable income environment for investors owning property in the UAE.

Population Growth and Residency Stability

Dubai’s real estate strength is backed by its demographic expansion. Population growth translates into housing demand and rental stability.

As per Property Finder, the city’s population exceeded 4 million in late 2025 and continues to grow at an average annual rate of approximately 3.5%.

This growth is largely fueled by skilled expatriates, business owners, and remote professionals relocating for economic opportunity and lifestyle advantages.

Additionally, property ownership in Dubai offers residency-linked benefits.

Investors purchasing qualifying properties valued at AED 2 million or more are also eligible for the UAE Golden Visa, granting long-term residency rights.

This policy enhances asset utility and strengthens long-term holding incentives, contributing to market stability.

Capital Appreciation Driven by Global Demand

While income generation is important, capital growth remains a core component of successful property investment.

According to a resale profits report from fäm Properties cited by Zawya, resale profits in Dubai reached AED 59.7 billion in 2024, representing a 34% YoY increase from 2023.

Premium districts such as Palm Jumeirah, Dubai Marina, Downtown Dubai, and Business Bay continue to demonstrate consistent price appreciation due to limited supply, lifestyle demand, and international buyer interest.

Also, Dubai ranked among the top global cities for prime residential price growth in Knight Frank’s Wealth Report 2025, placing third behind Seoul and Manila.

This demonstrates that real estate in Dubai is functioning as a long-term value asset rather than a flipping market.

Strategic Value for US Expats

For US expatriates, investing abroad requires careful consideration of risk, regulation, and long-term usability and stability. And Dubai addresses these concerns in multiple ways.

First, geographic diversification reduces dependency on domestic economic cycles.

Second, currency diversification mitigates exposure to dollar volatility.

Third, asset-backed income provides stability independent of equity market fluctuations.

Moreover, Dubai’s legal framework offers full freehold ownership rights for foreign investors in designated zones. These rights are protected under UAE property law and supported by transparent digital land registration systems.

<Pie-chart from previous blog showing the data for the percentage of different real estate investors in Dubai in 2025 (total 193,100 investors)>(for developer)

This regulatory clarity is essential for international investors seeking legal certainty. And the data above from the 2025 Buyer’s Pool Report supports the clarity and confidence in Dubai’s real estate legal framework.

More on the global forces shaping this momentum: Why Global Investors Are Choosing Dubai Real Estate in 2026

Where Danube Properties Aligns with Market Realities

Selecting the right developer is as critical as choosing the right market. Danube Properties has built its reputation around delivering affordable, well-located, and high-occupancy residential developments across Dubai.

The company’s focus on accessible payment plans, functional layouts, and community-driven design positions its projects for rental demand, capital appreciation, and resale liquidity.

For investors exploring property investment in Dubai, alignment with a developer that understands market cycles, tenant behavior, and regulatory compliance significantly reduces risk.

Our project pipeline reflects these fundamentals, making it a practical option for long-term-focused international investors. And our track record of successful projects backs our reputation, offering immense value for investors.

Is Dubai Truly a Financial Safe Haven?

Dubai’s evolution over the past two decades has transformed it from a regional development hub into a globally integrated investment ecosystem.

Strong governance, investor-friendly regulation, infrastructure investment, and economic diversification have created a market where capital can operate efficiently and securely.

The UAE’s Vision 2031 and Dubai 2040 Urban Master Plan further reinforce long-term policy stability, ensuring consistent economic growth and urban development.

This level of strategic planning reduces risk.

For US expats evaluating alternative assets, exploring Dubai’s real estate market is a must, especially with its upside of higher rental yield and zero tax.

Final Thoughts

The case for investing in Dubai is built on transaction records, yield metrics, demographic trends, regulatory transparency, and sustained international participation.

It’s safe to say that property investment in Dubai is data-backed and analytical.

For investors seeking reliable income, portfolio diversification, and capital preservation, property in the UAE, particularly in Dubai, not only offers quantifiable advantages that few global markets currently match, but also offers long-term residency.

When approached with proper due diligence and aligned with credible developers, Dubai’s real estate represents a structured and resilient asset class.