Dubai’s infrastructure has always been its engine. Roads, ports, airports, and most importantly, mass transit have historically shaped how capital moves across the city.

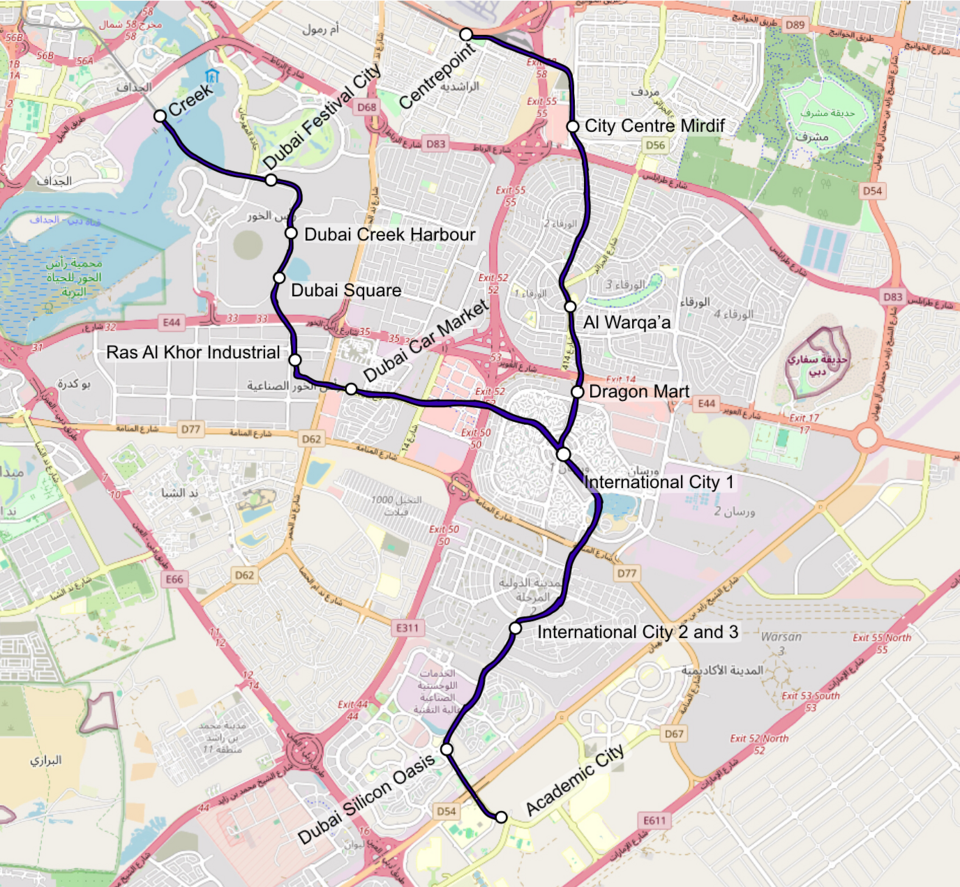

The Dubai Metro Blue Line, scheduled for completion in 2029, is another transportation upgrade and a structural shift that will directly influence real estate in Dubai, its pricing behaviour, rental demand, and long-term absorption across multiple districts.

And it has already proven its impact across the city.

Communities connected to the Red and Green Lines recorded measurable uplifts in both rents and capital values within 18-36 months of operational rollout.

This was back in 2009 and 2011. Development and urbanization have been faster in Dubai over recent years. And the Blue Line follows the same economic logic, but on a far wider scale, and people have already started investing in nearby areas.

Why Metro Connectivity Still Moves the Market

Globally, properties located within 500 to 800 metres of metro stations command premiums of 8 – 25%, depending on city maturity and density. Dubai’s own data mirrors this trend.

Haider Tuaima, managing director and head of real estate research at Valustrat, states that “Properties located within a 10-minute walk of the planned stations attract heightened interest even in the short term, as buyers look to capitalize on future investment potential.”

And as per the CBRE Dubai Metro Report 2023, properties within a 15-minute walk of metro stations saw prices rise by 43.8% on average, outpacing the wider Dubai by 2.6%.

- JBR and Dubai Marina saw a recorded price growth of 40.5% and 35.9%, respectively.

- Vacancy rates near stations were 30% lower during market corrections

- Discovery Gardens, Barsha Heights, and Al Furjan have seen average rental rates decrease by 35.0%, 15.1,% and 0.6% from Q1 2018 to Q4 2022.

Also, data from Backyard suggests that the rental rates near metro stations have been 15-30% higher than other areas across Dubai over the years.

In a city where population growth is projected to cross 5.8 million by 2040, efficient mobility is crucial.

It directly feeds into the property value in Dubai, especially for mid-income and HNW buyers, professionals, and investors.

The Dubai Metro Blue Line: What’s Different This Time

The Blue Line is expected to connect emerging residential clusters with major employment corridors, logistics zones, and airport-linked infrastructure.

Unlike earlier lines that focused on already-established districts, this phase cuts through growth-stage communities.

This fact is significant for property investment in Dubai, as early access to infrastructure translates to lower entry prices while future demand expands.

The Blue Metro line in Dubai is designed to:

- Reduce commute times by 20-30% for outer communities

- Ease pressure on arterial roads

- Support higher residential density near stations

- Trigger mixed-use zonal upgrades

Reviewing historical stats, we can say that infrastructure improves lifestyles and rewires pricing logic, which will soon happen across communities along the Metro Blue Line.

Communities Likely to See Price Acceleration

Metro-led price acceleration favours communities having rental demand and development momentum, but lacking frictionless connectivity.

According to Khaleej Times, properties near the Red Line, within 15 minutes walking distance, saw more than 25% price increase after the development of the Red Line in 2009.

Similarly, the Blue Line is a catalyst in the following zones, converting functional residential clusters into high-liquidity real estate markets almost overnight.

History plans to repeat itself. Properties near future Blue Line stations are also forecasted to appreciate up to 25%, with rents continuing 25-30% by 2029 as accessibility becomes a reality.

1. Dubai Silicon Oasis & Academic City Corridor

According to data from Betterhomes, Property Monitor, and internal records sourced from news reports, Academic City recorded the sharpest rise in rents since November 2023, with studio apartment prices increasing by 43%, rising from AED 42,000 to 60,000 per annum.

These zones, from DSO to Academic City, already house over 80,000 residents and workers combined.

With metro access, the appeal expands beyond students and tech professionals to long-term end-users and families.

Expect:

- Rental yields to stabilize between 7-9%

- Capital appreciation driven by end-user demand

- Strong absorption of mid-market apartments near the metro

This corridor is a textbook case of how infrastructure converts functional zones into residential and investment hotspots.

Danube’s Timez, Oasiz, and Oasiz 2 reflect the growing preference for modern, well-planned residential projects in Silicon Oasis. And it’s due to our balanced approach between affordability and long-term livability.

2. International City & Warsan

Historically price-sensitive markets, these areas have always benefited from affordability but suffered from perception gaps. Metro connectivity changes the narrative by 180°.

Data cited by Khaleej Times shows that budget-led districts near stations experienced:

- 18-28% rental growth over five years

- Higher tenant retention

- Improved resale liquidity

For investors aiming to invest in Dubai’s real estate without premium entry prices, this cluster offers asymmetric upside.

Our projects, Lawnz in International City and Olivz and Petalz in Warsan, illustrate how structured residential developments can elevate the sub-markets in the area once accessibility improves, particularly for working professionals and long-term tenants.

3. Mirdif & Al Warqa

Low-rise, family-oriented communities like Midrif and Al Warqa tend to react differently to metro access. Price growth here is slower but definitely more stable.

Data from Dubai’s real estate reports cites that the impact in:

- Increased transaction volumes

- Rising villa and townhouse demand

- 28% growth in property values

- Stronger long-term capital preservation

These districts appeal to residents seeking space without sacrificing connectivity, an increasingly valuable equation.

4. Dubai Creek-Ras Al Khor Growth Belt

Dubai Creek Harbour is where infrastructure meets long-term urban planning.

As quoted in Khaleej Times, the area saw a 30% increase in property values, reflecting strong demand in waterfront, mixed-use living.

The proximity to future commercial zones, waterfront redevelopment, and logistics hubs positions this belt as one of the most structurally advantaged regions.

Expect:

- Gradual but sustained price climbs

- Higher demand for new-build apartments

- Increased interest from institutional investors

This area ties directly into broader investment opportunities in Dubai for those focused on future-forward assets rather than immediate flips.

Danube’s footprint here, Breez, Bayz, Bayz 101, Bayz 102, and Oceanz, highlights how developers are already positioning inventory around infrastructure-backed growth.

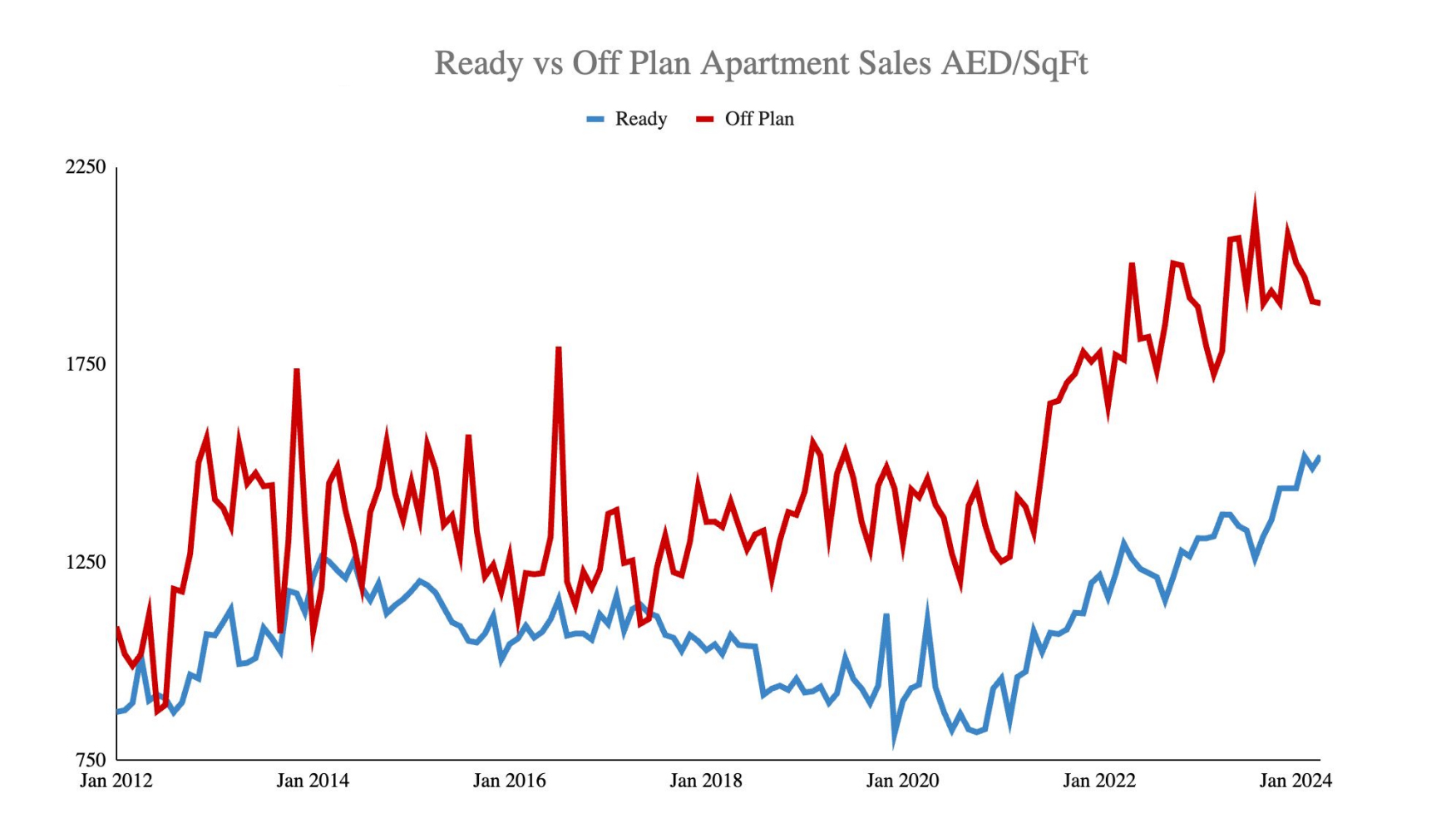

Off-Plan vs Ready: Where the Smart Money Moves

Off-plan apartments have attracted a lot of investor interest in recent years. And historically, metro announcements have influenced off-plan pricing before physical construction milestones.

Developers price in future accessibility early, while secondary markets react post-completion.

That creates a timing gap.

- Enter off-plan during infrastructure announcement phases

- Exit or refinance after operational launch

- Hold income-generating assets near stations long-term

This is where structured developers quietly outperform. Brands that combine metro-adjacent locations with flexible payment plans absorb demand faster.

And Danube Properties has consistently focused on accessible locations paired with affordability-driven payment structures.

Our strategy aligns well with transit-led demand for first-time buyers, end-users, and yield-focused investors. And it has consistently led to the success of our developments.

Numbers That Matter to Investors

| Area Type | 2021 Price (Per Sq Ft) | 2024 Price (Per Sq Ft) | Growth | Rental Yield |

|---|---|---|---|---|

| Within 500 m of Metro | AED 1,200 | AED 1,750 | 45.8% | 7.5–9% |

| 1–2 km from Metro | AED 1,100 | AED 1,450 | 31.8% | 5–8% |

| Non-Metro Areas | AED 950 | AED 1,150 | 21.0% | 4–6% |

Source: Backyard.ae

Takeaways:

- Properties within walking distance of metro stations in Dubai historically outperform citywide averages by 12%

- Rental demand spikes begin 6-9 months before metro completion

- Rental yields close to transport hubs sit at 7.5-9% vs. 5.5-6.5% further into the city, as per Backyard.

- Mid-market apartments show stronger ROI consistency than luxury segments post-infrastructure

What This Means for Dubai’s Real Estate in 2026

The Blue Line reinforces a larger truth: infrastructure-led pricing is back in control.

Speculative spikes are less influential than usability, connectivity, and long-term demand drivers.

This shift benefits:

- End-users prioritizing commute efficiency

- Investors focused on yield and sustainability

- Developers offering realistic pricing models with low entry points and high ROI

It also stabilizes Dubai’s real estate cycles by distributing demand more evenly across the city.

The Final Word

The metro expansion is not an isolated project. It ties into national population growth strategies, workforce mobility, and urban density optimization across the UAE.

Cities that plan mobility well attract capital, talent, and stable residency.

For property investment in Dubai, this means fewer “dead zones” and more distributed opportunities in communities that were previously undervalued due to access constraints.

Danube Properties’ presence, from Silicon Oasis and International City to Warsan and the Dubai Creek growth belt, reflects our vision and focus on accessibility, price, and long-term livability.

For those evaluating investment opportunities in Dubai, this phase rewards planning over speculation. Entering before full operational maturity defines long-term returns.

Infrastructure always whispers before prices speak out loud. And the Blue Line is doing just that steadily and with intent.