In 2026, Dubai’s real estate has firmly established itself as one of the world’s most institutionally respected, data-driven, and globally integrated property markets.

What began two decades ago as a regional development story has evolved into a mature international investment hub.

Today, global capital arrives in Dubai thanks to the city’s measurable returns, transparent regulations, and long-term economic planning.

For investors assessing property purchase in Dubai, the decision is increasingly being driven by numbers, policy, and structural advantages rather than hype.

This shift explains why 2026 marks a new phase in Dubai’s real estate evolution.

The Scale of Growth: What the Market Data Reveals

Dubai’s property sector has entered 2026 with momentum that few global cities can match.

According to the Dubai Land Department, the emirate recorded 270,000 transactions worth AED 917 billion in 2025, reflecting a year-on-year increase of upto 29% in value and 20% in number.

And that trend has been consistent over the past few years.

Source: DLD Annual Report

Dubai’s population officially surpassed 4 million in 2025, with growth of about 6.13% over the previous year, according to data from the Dubai Statistics Centre. This reflects a strong demographic expansion that supports the real estate demand.

Rental performance has followed the same trajectory. Dubai Estate reported gross rental yields ranging from 6-10%, with an average return of around 7.5% across major residential zones in 2025, among the highest in any major global city.

These figures place Dubai ahead of London, New York, Singapore, and Hong Kong in terms of net residential returns.

For investors, these numbers are the foundation of confidence.

Key Market Performance Indicators (2024-2025)

| Indicator | Dubai | London | New York | Singapore |

|---|---|---|---|---|

| Avg Rental Yield | 6–10% | 2.5–4% | 2.9–3.5% | 2–3.8% |

| Avg Price per Sq. Ft. | $550 | $1,500+ | $1,700+ | $1,200+ |

| Capital Gains Tax and Annual Property Tax | 0% | Yes | Yes | Yes |

| Annual Price Growth | 5–7% | 1–3% | 2–4% | 3–5% |

This comparison highlights why property investment in Dubai continues to outperform traditional global hubs.

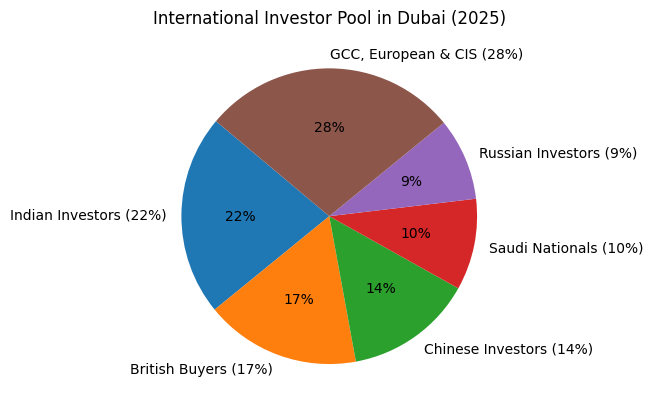

International Capital: Who Is Buying and Why

The buyers’ profile in Dubai reflects the market’s global relevance.

According to the 2025 Buyer’s Pool Report:

- Indian investors accounted for approximately 22% of foreign purchases

- British buyers represented 17%

- Chinese investors held 14%

- Saudi nationals contributed around 10%

- Russians invested about 9%

- GCC, European, and CIS investors made up the balance

This diversity matters because it reduces dependence on any single economy, creating a stable demand base.

More importantly, it demonstrates that buying property in Dubai for foreigners is no longer a niche activity. It has become a mainstream global investment strategy.

Legal Security and Ownership Rights

One of the strongest drivers behind Dubai property investment is legal clarity.

Foreign investors can own 100% freehold property in designated areas. Ownership is registered under the Dubai Land Department, supported by digital title deeds and escrow regulations.

Transparency is reinforced by the Dubai Land Department Regulatory Framework 2024:

- Mandatory escrow accounts for off-plan projects

- RERA oversight of developers

- Standardized sales contracts

- Digitized land registry systems

This level of institutional regulation rivals established Western markets and significantly reduces counterparty risk.

For global investors accustomed to restrictive ownership rules elsewhere, Dubai’s framework is a decisive advantage.

If you are a first-time foreign buyer, read The Dubai Property Purchase Process: A Step-by-Step Guide for Overseas Buyers.

Infrastructure and Economic Expansion

Real estate performance in Dubai is closely tied to broader economic planning.

The Government of Dubai announced infrastructure investments in 2025 that exceed 46% of its total spending across transportation, logistics, healthcare, and digital services.

Major developments include:

- Dubai Metro Blue Line expansion

- Al Maktoum International Airport Phase 2

- Dubai South logistics corridor

- Smart city infrastructure upgrades

These projects directly support population growth, employment creation, and long-term tenant demand.

Infrastructure investment remains one of the strongest predictors of property value appreciation. And Dubai continues to lead the region in this regard.

Liquidity: An Overlooked Advantage

Liquidity is one reason institutional investors continue to allocate capital to Dubai.

According to Zawya, Dubai’s secondary market activity rose to 41.1% of all residential transactions in H1 2025, demonstrating strong resale demand and market maturity.

This means properties can be exited efficiently when reworking a portfolio.

In contrast, many emerging markets show less than 20% resale participation, increasing exit risk.

Tax Structure and Net Returns

Dubai’s tax framework remains one of the most investor-friendly globally.

- No capital gains tax

- No annual property tax

- No inheritance tax on real estate

- No tax on rental income

When combined with high rental yields, this creates superior net returns.

For example, a 7.5% gross yield in Dubai remains largely intact. In London, a 5% yield can fall below 3% after taxation and charges.

This difference compounds significantly over long-term holding periods. And for investors seeking sustainable income, this structure is fundamental.

More on tax efficiency: Tax Edge for HNIs: Why Dubai’s Residential Real Estate Continues to Lead

Residency and Long-Term Stability

The introduction of long-term residency through property ownership has transformed investor behaviour.

Under the Golden Visa program, investors purchasing property worth AED 2 million or more qualify for 10-year renewable residency, a landmark initiative from the Federal Authority for Identity and Citizenship, UAE.

This has shifted investment patterns from short-term speculation to long-term asset holding.

Many investors now combine property purchase in Dubai with residency planning, education access, and business setup.

This stabilizes demand and reduces volatility.

Why Institutional Investors Are Increasing Exposure

Dubai is attracting more and more private investors, funds, REITs, and family offices.

According to GCC Business Watch, the Dubai real estate investor community grew to around 193,100 participants, reflecting a 24% year-on-year rise, with 129,600 first-time investors entering the market, a 23% increase compared to the previous period.

And key drivers for this include:

- Predictable regulatory environment

- High occupancy rates

- Demographic expansion

- Tourism growth, exceeding 18 million visitors annually

- Currency peg to the US dollar

These factors reduce macroeconomic risk. As a result, Dubai is increasingly viewed as a core portfolio market rather than an opportunistic play.

More on investing: How to Build a Profitable Real Estate Portfolio in Dubai in 2026

The Role of Quality Developers

Market maturity also depends on developer standards.

Reputable developers with strong delivery records, transparent payment structures, and long-term community planning have become central to investor confidence.

In this environment, Danube Properties has gained recognition for offering projects aligned with international buyer expectations with structured payment plans, investor-focused layouts, and strong after-sales management.

For global buyers navigating the market, working with established developers significantly reduces execution risk.

Conclusion: A Market Built on Fundamentals

The global shift toward Dubai’s real estate is driven by data and the city’s governance, economic planning, and measurable returns.

Investors are choosing Dubai because it delivers what modern portfolios require: performance, security, and scalability.

In an uncertain global environment, few markets offer the same combination.

For those pursuing long-term property investment in Dubai, 2026 represents not the peak of opportunity, but the consolidation of a market that has earned its place among the world’s most reliable real estate destinations.

And that is precisely why global capital continues to arrive in Dubai: quietly, consistently, and with conviction.