Every few years, when markets slow down, the word ‘crash’ goes viral dramatically. But it doesn’t have to be true.

In 2026, conversations around Dubai property prices are louder, more polarized, and a little misleading as well.

What the Dubai real estate market is experiencing right now is something far more measured: a buyer-led recalibration through the lens of long-term value, yield, and timing.

One that seasoned investors, developers, and analysts recognize as a transition phase.

This shift becomes clearer when we strip the noise and analyze behavior patterns and structural fundamentals shaping property investment in Dubai in 2026.

Dubai Real Estate in 2026: The Power Shift

Between 2021 and 2024, Dubai’s property prices surged at a pace that few global cities could match.

Prime and mid-market residential values climbed between 30-40% in many communities, driven by post-pandemic migration, foreign capital inflows, and policy-driven confidence in the UAE.

According to the Dubai Land Department, the total real estate transactions in Dubai crossed AED 682.49 billion in 2025, overtaking the entire 2024 tally by a whopping 30.4%. [Gulf News, Jan 2026]

December 2025 alone closed with 18,575 transactions, based on DLD monthly transaction records, signalling a shift toward a more balanced, price-conscious market.

This is not a crash because prices are not collapsing, liquidity hasn’t dried up, and transactions haven’t frozen.

Instead, volumes remain strong, but the balance of power has shifted from sellers to buyers.

The Supply Conversation: Big Numbers and Context

Fitch Ratings has adopted a cautious outlook, projecting a moderate price adjustment of up to 10-15% starting in late 2025 and continuing into 2026. [International Investment May, 2025]

This estimate is driven by reports suggesting over 120,000 deliverable units in 2026.

On the other hand, Dubai’s population has crossed 3.84 million in 2025, and is set to grow at one of the fastest rates globally.

Corporate relocations, the UAE Golden Visa, retirement residency options, and long-term employment visas have structurally changed who is moving to Dubai.

Unlike past cycles, today’s real estate market trends are rooted in population growth, and value functionality, accessibility over luxury.

Dubai Property Prices: Stabilisation Following Rapid Growth

Price movements in 2026 reflect market normalization rather than decline.

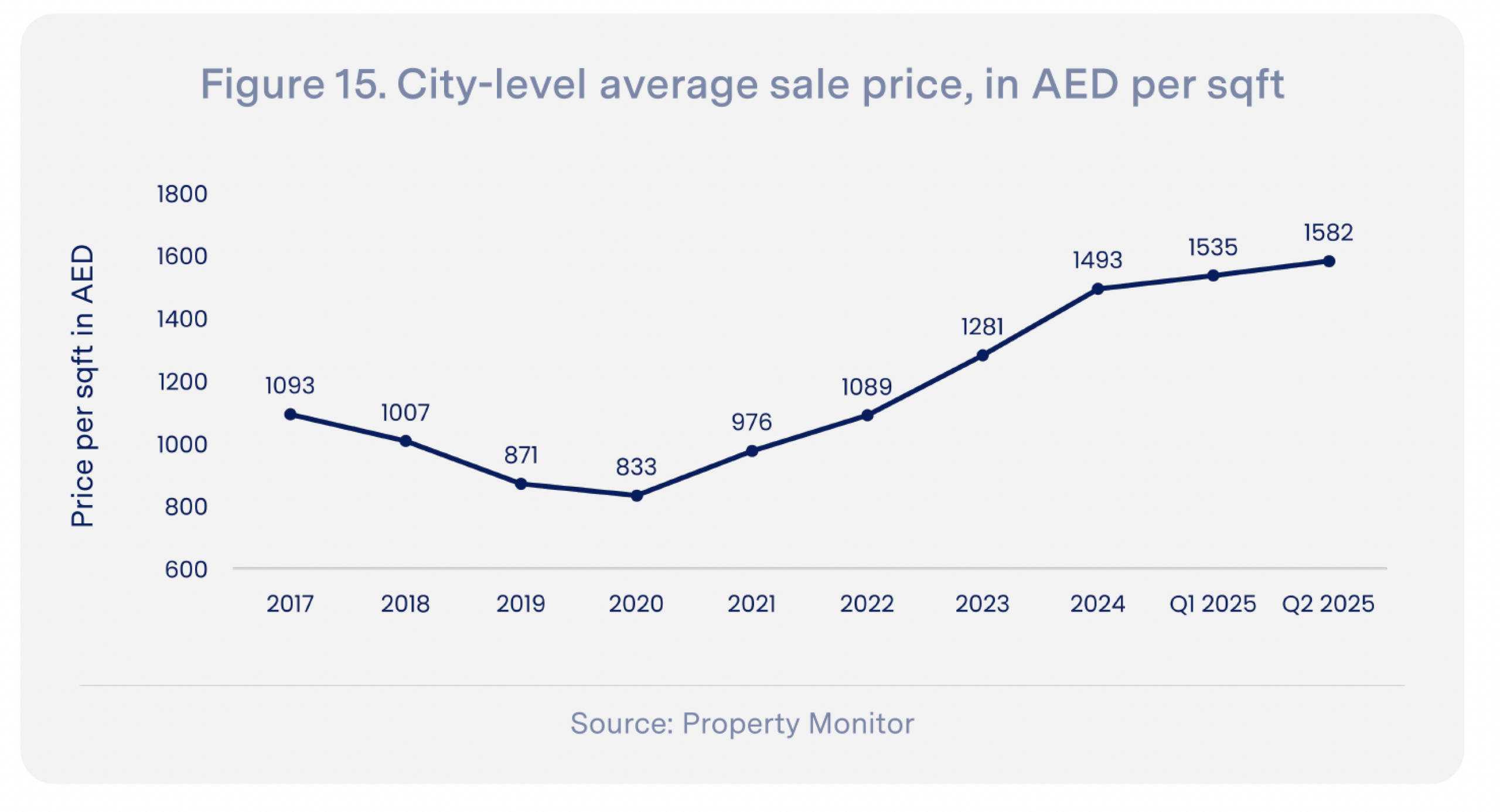

The citywide average price reached AED 1,582 per square foot in H1 2025, which is 18% higher than Q1 2024 and about 90% above pandemic-era lows, as per a Q2 2025 Dubai Residential Market Report.

Rating agencies and institutional analysts have noted the possibility of limited price corrections in specific submarkets.

However, none anticipate systemic declines or forced selling, primarily due to strong equity positions among owners.

Rental Yields: The Market’s Silent Stabilizer

For anyone evaluating property investment in Dubai, yields significantly matter.

While appreciation is said to have cooled down, the rental performance is still very consistent.

According to data reported by Engel & Völkers, Dubai continues to offer average gross rental yields of 4-7%, with certain mid- and high-growth communities reaching 8-9%.

Globally, this factor places Dubai’s real estate among the top-performing yield markets, outpacing cities like London, New York, and Singapore.

This yield resilience critically supports investors and creates a natural price floor that’s justified.

What a Buyer’s Market Actually Looks Like

Buyer’s markets aren’t about falling prices alone. They’re about leverage. And leverage is back to the buyer’s side in 2026.

Property buyers are looking at:

- Longer payment plans

- More post-handover options

- Easy and efficient purchases

- Willingness to negotiate

Since these conditions were nearly impossible to secure during peak demand years, the ability to structure cash flow sensibly has returned, greatly improving the experience of those looking to buy property in Dubai.

This is the normalization that favors informed buyers, not a market crash.

The Role of Off-Plan Properties

Off-plan transactions continue to dominate Dubai’s sales volumes, accounting for 62.6% of activity as per the Dubai Off-plan Market Report by Oplus Realty.

When pricing resonates with real demand, when delivery timelines are credible, and when payment plans reduce upfront exposure, off-plan property becomes a strategic investment.

However, developer credibility plays a decisive role in off-plan properties. Developers offering long-term affordability, realistic layouts, and community-driven planning are seeing consistent absorption.

In a market where buyers are more analytical, that approach becomes a competitive advantage.

That’s exactly how Danube Properties has built its portfolio around accessible price points, extended payment structures, and projects designed for livability.

Comparing Dubai Property Market Trends: 2024 and 2025

To provide a clear, data-driven perspective on Dubai’s real estate market trajectory, the table below summarizes key metrics from 2024 and 2025:

| Metric | 2024 | 2025 | Trends |

| Total Transaction Volume (annual) | 180,987 | 215,736 | 19.19% increase |

| Total Real Estate Transaction Value (annual) | AED 522.36 Billion | AED 682.49 Billion | 30.64% increase |

| Off‑plan Share of Transactions | Approx. 60% | Approx 62.6% | 2.6% increase |

| Average Price Per Sq.Ft (Citywide) | AED 1,600 | AED 1,692 | 5.75% increase |

Why Developer Reputation Matters

As markets mature, brand trust replaces hype.

Buyers are asking analytical questions like:

- Will this project absorb well?

- What’s the best payment plan with the lowest risk?

- Is the location livable five years from now?

Developers who convince with confidence and live up to it by delivering on time turn successful.

And with supply increasing, real estate market trends across Dubai turn toward trust, filtering out weaker players without destabilizing the market.

Global Capital Becomes Smarter

Despite global interest rate pressures, Dubai continues to attract international capital. Investors still view the city as a hedge against inflation, currency volatility, and geopolitical uncertainty.

The reasons remain unchanged:

- Zero property tax

- Transparent regulations

- Strong rental demand

- Long-term residency incentives

With its visionary leadership, the UAE has positioned itself as a stable, investor-friendly ecosystem. And that confidence reflects directly in transaction data.

As per The Times of India, property transaction values grew strongly, climbing from AED 345 billion in H1 2024 to AED 431 billion in H1 2025, representing a 25% year-on-year increase. [6]

So capital in Dubai’s real estate has massively increased, and is now becoming more sophisticated and selective.

Is 2026 the Right Time to Buy Property in Dubai?

If the expectation is instant appreciation, 2026 may feel like a slow year.

If the goal is strategic entry, stable yield, and flexible structuring, Dubai property investments in 2026 make a strong case.

Cooling Dubai property prices, rational supply, resilient rentals, and buyer-friendly terms create a rare combination: opportunity without urgency.

And this is exactly the environment where smart investments are made.

Final Thoughts

The Dubai property market in 2026 isn’t collapsing. It’s catching its breath. It’s maturing. It’s moving into a new phase.

For those willing to understand fundamentals, this phase offers something rare: choice, leverage, and time. And in property investments, these things separate regret from returns.

Whether it’s through off-plan projects, apartments, or developers who understand long-term absorption, Dubai’s real estate is transitioning toward infrastructure, functionality, and livability, compared to the previous allure of luxury.

The buyers who understand that shift and benefit from this transition will be the ones who look back at 2026 and call it the year smart money moved in calmly.

Your Partner for Smart Investments: Danube Properties

Danube’s projects are structured around extended payment plans, post-handover flexibility, and apartments designed for real end-users, aligning closely with where buyer demand is moving.

With 40+ lifestyle amenities, locations with strong rental absorption, and price points that lower entry barriers, it becomes clear why Danube continues to attract both investors and residents in a more selective market cycle.